The Efficiency-Equity Tradeoff of the Corporate Income Tax: Evidence from the Tax Cuts and Jobs Act

20 May 2024

Patrick Kennedy (UCLA, NBER, and JCT)

Business tax paper of the month - May 2024

The impact of corporate tax reforms is complex: reducing tax rates may boost investment, raise shareholders’ returns, and increase workers' earnings, but these benefits may be distributed unevenly throughout the economy.

In a recent paper “The Efficiency-Equity Tradeoff of the Corporate Income Tax: Evidence from the Tax Cuts and Jobs Act” (joint with Christine Dobridge, Paul Landefeld, and Jacob Mortenson), we study the effects of corporate tax cuts on firms and workers, exploiting policy variation from the 2017 Tax Cuts and Jobs Act in the United States. Using employer-employee matched confidential tax records, we identify causal effects in an event study framework, comparing trends in outcomes of firms that are similarly sized and operate in the same industry but faced different tax changes after TCJA due to their pre-existing legal status as C corporations or S corporations.

The main findings are:

1) The tax cuts led to efficiency gains in the economy, as firms receiving larger tax cuts were more likely to increase their investment, labor demand, and profits.

2) The tax cuts also led to an increase in inequality, with roughly half of the gains from the tax cuts flowing to corporate shareholders, and the other half flowing to highly paid workers and executives.

3) We do not find evidence that smaller or cash-constrained firms were more responsive to the tax cuts, suggesting that the mechanism was a price effect operating through reductions in the cost of capital rather than income effects.

4) Overall, we interpret these results as evidence that policymakers face an efficiency-equity tradeoff when setting corporate tax policy.

Background and Methodology

TCJA significantly lowered the corporate tax rate from 35% to 21% for C corporations, but lowered tax rates for S corporations by much less. Leveraging this policy variation, our methodology builds on the research design first developed by Yagan (2015), and compares trends in outcomes of C and S corporations over time, controlling for firm and industry-size-year fixed effects. C and S corporations operate in the same industries and broadly overlap in their size distributions, inviting a natural comparison between the two.

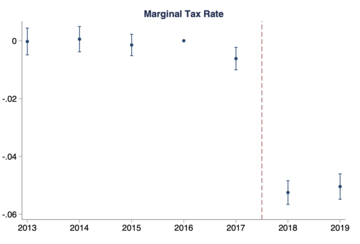

The figure below shows that trends in the marginal tax rates of C and S corporations were similar in the years before TCJA. After TCJA, tax rates declined by 5-6 percentages points for C firms relative to S firms.

Figure 1: The tax reform

Findings on Firms

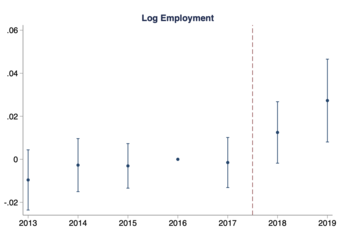

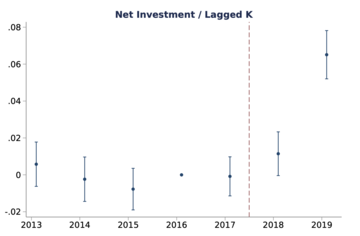

We find that corporate income tax cuts led to substantial increases in the economic activity of C relative to S corporations. Sales, profits, employment, payrolls, and real investment in capital goods all showed significant increases. The effects were particularly pronounced in capital-intensive industries, suggesting a reduction in the cost of capital rather than liquidity effects as the driving force. The figures below show the event study plots for employment and investment.

Figure 2: The effect on employment

Figure 3: The effect on investment

Findings on Shareholders and Workers

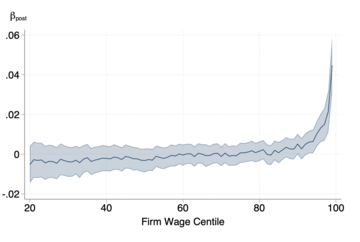

We document that TCJA sharply increased the after-tax profits and shareholder payouts of C corps relative to S corps. Moreover, we show that TCJA's impact on workers' earnings was highly skewed towards the top earners within firms. The figure below plots the estimated log earnings effects and 95% confidence intervals for workers across the within-firm earnings distribution. The effects are statistically indistinguishable from zero below the 90th percentile, but increase sharply and become statistically significant for the top 10%.

Figure 4: The effect on workers’ earnings

Robustness

We conduct extensive robustness checks to ensure that our estimates are driven by changes in corporate tax rates rather than simultaneous policy changes, differences in the industry-size composition of C versus S corps, or various forms of profit shifting. We also show that our results are consistent with highly nuanced cost of capital models in the style of Auerbach and Hasset (1992).

Adding it all up

We estimate key elasticities of outcomes with respect to the tax changes from the event studies, and embed these elasticities in a stylized model to assess the impacts of the corporate tax cuts on government revenues, private incomes, and the distribution of benefits across the income distribution. While economic growth from the tax cuts modestly offsets their revenue cost to the government, the tax cuts did not pay for themselves. Our model estimates imply that the corporate tax cuts modestly increased annual GDP by approximately 0.18%. Accounting for gains to workers and for the fact that many people hold equity portfolios, we estimate that approximately 80% of the income gains flow to the top 10% of the income distribution.

Discussion, Implications, and Future Research

Our study provides evidence that corporate tax cuts led to significant economic benefits for firms, which expanded their investment, payrolls, and profits. However, these benefits are unevenly distributed, disproportionately favoring shareholders, high-income workers, and executives. The findings suggest that while corporate tax cuts can boost economic activity, they also exacerbate income inequality.

Lastly, we caveat that it is possible that the long-run effects of the tax cuts will lead to broader gains for workers, although the evidence for this remains yet to be seen. Moreover, it is also possible that the tax changes affected prices, entrepreneurship, tax competition, and international activity in ways that we cannot yet observe in our data. We look forward to and welcome more research on these topics in the future.

References

Auerbach, A. J. and K. Hassett (1992). Tax Policy and Business Fixed Investment in the United States. Journal of Public Economics 47(2), 141–170.

Yagan, D. (2015). Capital Tax Reform and the Real Economy: The Effects of the 2003 Dividend Tax Cut. American Economic Review 105(12), 3531–63.

This blog is based on the following paper:

Kennedy, P., Dobridge, C., Landefeld, P. and Mortenson, J. The Efficiency-Equity Tradeoff of the Corporate Income Tax: Evidence from the Tax Cuts and Jobs Act.