Business Rates and the High Street

UK town centres are widely perceived to be in decline. As The Times newspaper recently observed: "More empty shops, fewer pubs, more fast-food restaurants and fewer shoppers. After Covid lockdowns, restrictions and changing customer behaviour, the future of the high street looks more uncertain than ever." 1

This process of decline has been accelerated by Covid but was already present beforehand. Why is this happening? Part of the explanation for the decline is undoubtedly the rise of online shopping. However, another major factor may be the high level of taxes on business property in the UK. Indeed, the British Retail Consortium has just called on the government to reduce these taxes, known as business rates, following a finding that one in seven shops across the UK are vacant.2

Business rates are set at national level in the UK, and are a significant burden on businesses, relative to comparable taxes in other countries. For example, business rates in the UK accounted for 4.4% of the total tax revenue in 2018, a higher figure than France, the Netherlands and Germany, where comparable taxes account for 1.4%, 1% and 0.6% of total tax revenues, respectively.

There has been particular concern that this burden falls more heavily on small businesses, and more recently, is also creating a disadvantage for "bricks and mortar" retailers vis a vis online ones. As a result, two important reliefs, the small business rate relief (SBRR), and retail relief, have been introduced in recent years. There is also a third relief, the empty property exemption. The effects of these reliefs are also of interest because to mitigate the economic impact of Covid-19 - the UK government has given temporary relief for properties in retail and hospitality sectors; no commercial property taxes had to be paid until June this year, and from July 2021 to March 2022 the burden is reduced by 2/3.

In our research, Tax and Occupancy of Business Properties: Theory and Evidence from UK Business, we study the effect of business property taxes on the utilization of business properties in the UK, using these property relief schemes to identify the effect of the tax on vacancy and occupation rates of business properties.

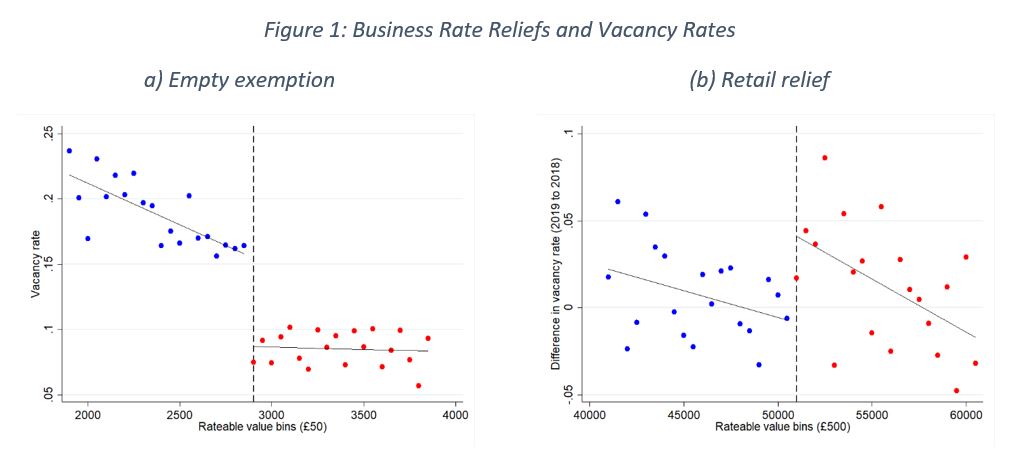

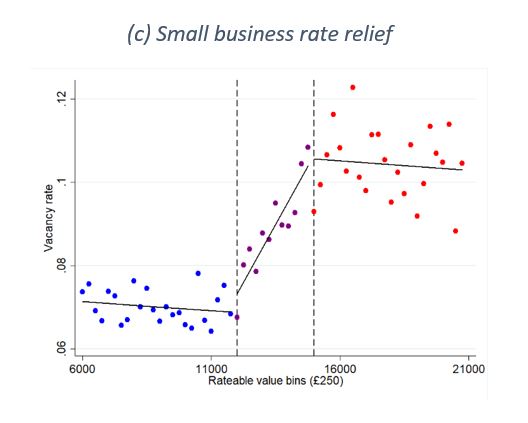

Empty property relief gives full relief from the business rate for all empty properties with a rateable value of below £2,900. Panel (a) of the graph below shows that this relief has a substantial effect; properties just qualifying for the relief (with rateable values just below £2,900) are around twice as likely to be vacant than those just not qualifying (with rateable values just above £2,900).

Retail relief was announced in 2018 to give a one third reduction from April 2019 in business rates for occupied retail properties with a rateable value below a threshold of £51,000 (properties around the threshold would be large shops, such as department stores or units in shopping centres). Panel (b) of the figure shows how the vacancy rate changed for qualifying properties below and above the threshold following its introduction. Properties unaffected by the change, just above the threshold, saw their vacancy rate rise by around 4 to 5 percentage points on average. However, properties affected by the change, just below the threshold, had almost no change in their vacancy rates. As the vacancy rate above the threshold is around 10%, this means the retail relief reduces the vacancy rate of retail properties below the threshold by almost 50%.

Panel (c) shows the effect of SBRR on vacancies. This is a more complex relief than the other two, as it is gradually withdrawn as the rateable value rises from £12,000 to £15,000. This panel shows that the vacancy rate for properties fully qualifying for the relief is around 7%, but for properties not qualifying, it is around 11%.

These graphs demonstrate that all the schemes have significant effects on the vacancy rate. One way of summarising the effects is to identify the effect on the vacancy rate of a change in the effective tax rate (ETR) (i.e., the tax payable as a fraction of rateable value) of the qualifying property. Retail Relief has the largest "bang for the buck" for the government: a 1 percentage point reduction in the ETR due to this relief reduces the vacancy rate by 0.53 percentage points. Given that on average around 10% of properties around the retail relief threshold are vacant, this represents a significant reduction in vacant properties of around 5 percent.

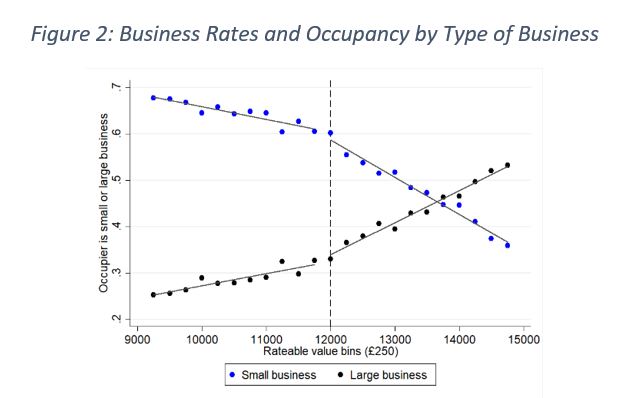

We also study another aspect of SBRR. As the name implies, this relief is targeted at small businesses, defined as those who only occupy one property. The effect of this on the mix of firms occupying small properties is shown in the figure below.

This shows that that the relief has the desired effect on the occupancy mix of small properties; at the £12,000 threshold, about 61% of properties are occupied by small businesses, and 32% by large businesses, with the remainder being vacant. These fractions then change rapidly at higher rateable values as SBRR starts being withdrawn, with these percentages being nearly fully reversed by the point at which SBRR is fully withdrawn.

Overall, our results provide strong evidence that the taxation of commercial properties affects the utilization of properties – and they imply that business rate reliefs and exemptions are an effective policy tool to stimulate economic activity.

If the policy objective is to mitigate the decline of the UK High Street, the retail relief should be expanded (once the temporary relief due to Covid-19 is reversed). By contrast, reliefs for business rates for empty properties could be removed to recover part of the potential revenue shortfall, which would further increase the occupancy of commercial properties.

1 The Times, May 31, 2021.

2 British Retail Consortium press release, July 30, 2021.