Tax Audits: Long-run Impacts on Intentional and Unintentional Non-Compliance

17 July 2024

Tobias Christiansen (University of Copenhagen)

Business tax paper of the month - July 2024

Tax audits have long been a tool for increasing taxpayer compliance and reducing evasion, but their impact can vary greatly depending on the taxpayer's intentions to comply. In a recent article “The dynamic effects of tax audits and the role of intentions”, I show how tax audits foster higher levels of compliance among taxpayers who inadvertently make mistakes due to confusion or inattention (Christiansen, 2024). Conversely, those who deliberately evade taxes—and are typically subject to operational audits—show no increase in compliance. This finding suggests that tax agencies can optimize their resources and achieve better compliance by targeting those who respond strongly to audits or by adopting more cost-effective measures such as personalized guidance to reduce inadvertent misreporting.

Building on previous research showing that audits can increase future tax payments (Kleven et al. 2011, DeBacker et al. 2018, Advani et al. 2023), I analyze data from over 17,000 randomized tax audits of self-employed individuals conducted by the Danish Tax Agency between 2006 and 2017 to assess the variation in taxpayer responses to audits. This is done by comparing the tax payments of audited and not-yet-audited taxpayers, using the methodology developed by Callaway and Sant’Anna (2020).

Specifically, I use novel information filed by the compliance officers indicating the severity of non-compliance to categorize taxpayers into unintentional and intentional non-compliers based on their perceived willingness to comply with tax rules. This categorization may predict how taxpayers respond to audits. Unintentional non-compliers, who under-report due to confusion or lack of knowledge, may benefit from audits as a guide for future compliance. In contrast, intentional non-compliers may react differently depending on their perception of detection risk, influenced by factors such as their ability to evade taxes and the expertise of the auditor.

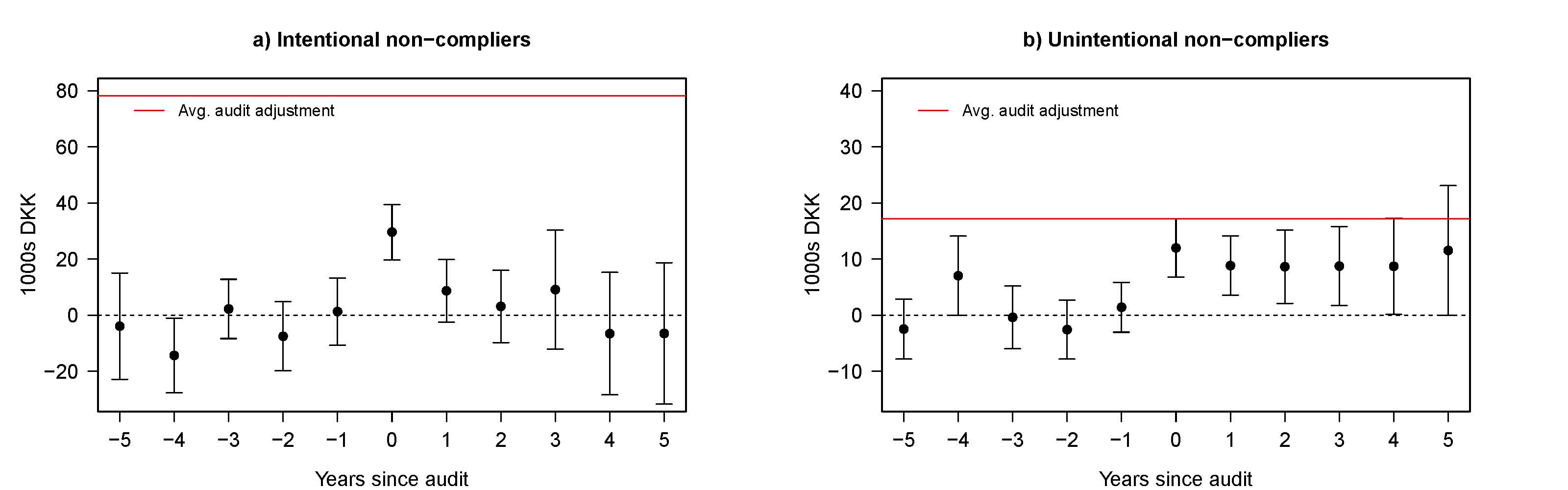

Figure 1 shows how tax payments change for the two groups in a 10-year window around audits conducted in year 0. One the one hand, unintentional non-compliers significantly improve their tax compliance after an audit (right panel). Over five years, the cumulative increase in tax payments equals 340% of the adjustment made in the audit. On the other hand, intentional non-compliers show little or no improvement in future compliance. The immediate increase in tax payments is only 38% of the adjustment made in the audit, reflecting deferrals allowed by the tax regulations, and the dynamic effect on tax payments is negligible.

Figure 1: Long-run effects of tax audits

Note: The figure shows subsequent tax payments of intentional non-compliers (panel a), and unintentional non-compliers (panel b) following a tax audit. Source: Christiansen, T. G., (2024)

The findings also reveal that audits can serve as personalized guidance to help taxpayers accurately report their income in the future, which extends beyond the typical focus of audits solely as a deterrent measure (Advani et al., 2023; Allingham and Sandmo, 1972; DeBacker et al., 2018; Kleven et al., 2011), and shows the importance of inattention and misunderstandings of complex tax regulations as a determinant of non-compliance (Alm et al., 2010)

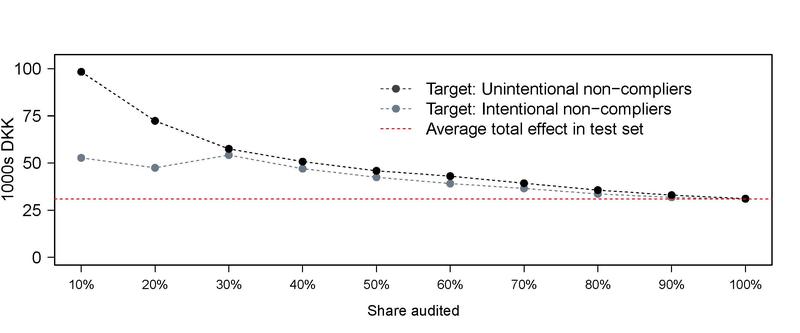

Next, I study how tax authorities can use this information to enhance audit selection strategies. By targeting unintentional non-compliers with a higher likelihood of responding positively to audits, tax agencies could increase revenue by 87% compared to traditional methods focused on the least compliant taxpayers. This approach is detailed in Figure 2, which compares the total revenue gain (including long-run responses) from different audit strategies.

This revenue-focused audit targeting strategy has an unappealing consequence: Tax authorities would need to shift audit resources from less compliant to more compliant taxpayers, which may be perceived as unfair and undermining overall compliance (Murphy, 2004). Since the guidance provided by audits appears to be the driving factor of long-term compliance among unintentional non-compliers, targeted and personalized approaches—like sending tailored letters or emails to clarify misconceptions identified during audits—offer a potentially more viable and cost-effective alternative to traditional audits.

Figure 2: Different targeting strategies

Note: The figure compares the average total revenue gain from audit (including long-run responses) obtained from targeting unintentional and intentional non-compliers. Models targeting intentional and unintentional non-compliers are trained on data from 2006-2012 (training set) and tested on data from 2014-2017 (test set), by ranking taxpayers according to risk scores and auditing from the top. Source: Christiansen, T. G., (2024)

In conclusion, I show how tax audits impact compliance among self-employed individuals with varying intentions to comply. Audits effectively increase compliance for those making inadvertent mistakes but show no such effect on deliberate evaders typically targeted by operational audits. This highlights the potential for tax agencies to boost revenue by focusing audits on responsive taxpayers. Alternatively, personalized guidance emerges as a cost-effective strategy to reduce inadvertent misreporting due to complex tax rules. Tailoring these approaches holds the potential to enhance compliance and efficiency within tax systems.

This blog is based on the following paper: Christiansen, T. G. (2024). “Dynamic effects of tax audits and the role of intentions”, Journal of Public Economics, 234, 105121.

References:

Advani, A., Elming, W., & Shaw, J. (2023). “The Dynamic Effects of Tax Audits”. The Review of Economics and Statistics, 105 (3), 545–561

Allingham, M. G., & Sandmo, A. (1972). “Income tax evasion: A theoretical analysis”. Journal of Public Economics, 1, 323–338

Alm, J. (2019). “What Motivates Tax Compliance”. Journal of Economic Surveys, 33 (2), 353–388.

Callaway, B., and Sant’Anna, P. (2020). “Difference-in-Differences with Multiple Time Periods”. Journal of Econometrics, 2020, 225 (2), 200–230

Christiansen, T. G. (2024) “Dynamic effects of tax audits and the role of intentions”. Journal of Public Economics, 234, 105121.

DeBacker, J., Heim, B., Tran, A., & Yuskavage, A. (2018). “Once bitten, Twice Shy? The Lasting Impact of Enforcement on Tax Compliance”. The Journal of Law and Economics, 61 (1), 1–35

Kleven, H. J., Knudsen, M., Thustrup, C. T., Pedersen, S., & Saez, E. (2011). “Unwilling or Unable to Cheat? Evidence From a Tax Audit Experiment in Denmark”. Econometrica, 79 (3), 651–692.

Murphy, K. (2004). “The role of trust in nurturing compliance: A study of accused tax avoiders”. Law and Human Behavior, 28 (2), 187–209

Slemrod, J. (2019). “Tax Compliance and Enforcement”. Journal of Economic Literature, 57 (4), 904–954