The Impact of Pillar II on Incentives: a trade-off between revenue and investment

In its Global Anti-Base Erosion (GloBE) proposal (also commonly referred to as Pillar II), the OECD has proposed a minimum tax to be paid by multinationals on their foreign profits. Recent CBT Blogs have already summarised the key components of the GloBE proposal and so in this blog we assume familiarity with the GloBE’s proposed income inclusion rule, and the two main options for applying this rule, namely the country-by-country and the blending approaches.

We focus here on the changes that the income inclusion rule is likely to induce to the incentives faced by multinational companies. We analyse this using a simulation model that we have developed, and which is set out in more detail in the CBT report entitled “The OECD Global Anti-Base Erosion (GloBE) Proposal”. Our simulation model allows us to make predictions regarding the impact of the GloBE’s income inclusion rule on (i) incentives to choose a particular location for investment; decisions on (ii) how much to invest, conditional on the chosen location; and (iii) on how much profit to shift to a tax haven.

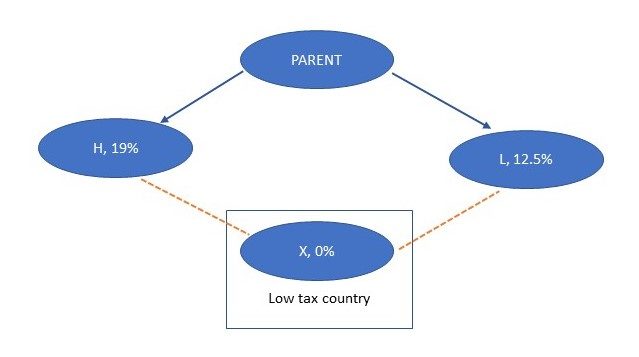

The basic structure of the model has a parent company, which chooses whether to locate its real economic activity in a subsidiary in country H (with a 19% tax rate) or in country L (with a 12.5% tax rate). The parent chooses the location which will yield the highest post-tax profit. In either case, it then chooses how much to invest, and how much of the resulting profit to shift to a subsidiary in country X (with a zero tax rate). This is illustrated in the diagram:

In the model the extent of profit shifting is taken from consensus estimates in the empirical literature, and depends on the difference in the statutory rates between the two countries between which profit is shifted. The choice of location depends on the effective tax rate (ETR)[1] faced in H and L, after some profit has been shifted to X. The choice of how much to invest depends on the cost of capital in each location, again after some profit has been shifted to X.

There are important differences in the impact on incentives between the country-by-country approach and the blended approach, which would apply the income inclusion rule to the multinational as a whole.

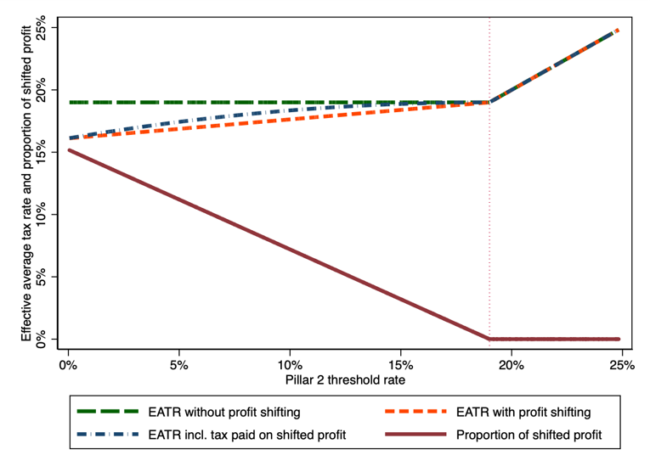

Figure 1a shows the position for the country-by-country approach for investment in country H. The horizontal axis reflects possible levels of the minimum tax threshold under the income inclusion rule. The existing position would be where the threshold is zero, at the far left of the diagram. As the threshold rises, the ETR in country Z will rise, and so make profit shifting less attractive. The downward-sloping unbroken line in Figure 1a shows how profit shifting declines as the threshold rises. In turn, this raises the ETR on investment in H.

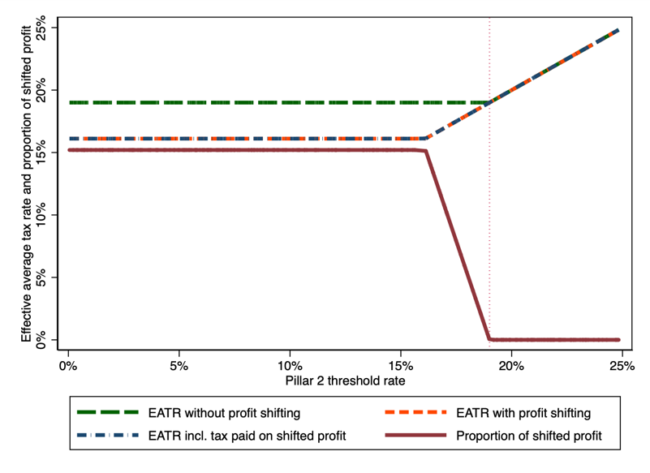

Figure 1b shows the position under the blended approach. In this case, a low threshold does not affect the extent of profit shifting, since the overall ETR of the multinational remains above the threshold. Only when the level of the threshold rises above the overall ETR of the multinational is profit-shifting affected, in this case at a threshold of around 16%. As a result the ETR for investing in H is also not affected until the threshold reaches 16%.

Figure 1a. Profit-shifting and ETRs under the country-by-country minimum tax

Figure 1b. Profit-shifting and ETRs under the blended minimum tax

More generally, the level of the threshold at which the income inclusion rule would have an impact depends on the tax rates in the countries concerned; so a similar analysis also applies to investment in L, although with different rates of ETR and profit shifting.

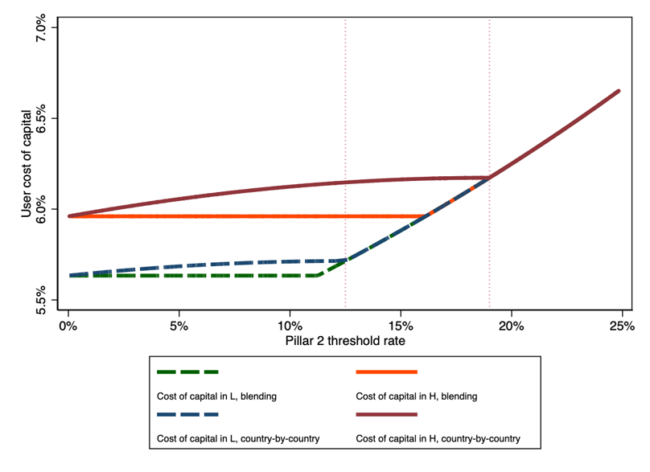

By reducing the incentive to shift profits, the country-by-country approach also increases the cost of capital more dramatically than does the blending approach (as shown in Figure 2), and therefore is likely to depress investment. The blended approach has a similar effect at high levels of the threshold but has little or no impact at low levels of the threshold.

Figure 2. Impact of the income inclusion rule on cost of capital

An argument in favour of the income inclusion rule, made by Englisch and Becker (2019)[2] , is that it could induce a lower dispersion in ETRs amongst alternative locations for investment. If this were the case, it could improve worldwide economic efficiency, in that location decisions would be less distorted by tax considerations. This is not necessarily the case in principle, since profit shifting from H to X and from L to X tends to reduce the dispersion of the overall ETRs from investing in H or L. Only if the threshold is high enough might the income inclusion rule reduce the dispersion in the ETRs. Our simulation analysis suggests that neither the country-by-country, nor the blending, approach would result in a clear convergence of ETRs, at least around the thresholds currently under discussion at the OECD.

As a result, there is a clear – and perhaps unsurprising - trade-off between the aims of reducing profit shifting and supporting investment. Implementing the income inclusion rule increases taxes paid, and hence would increase the cost of capital, and so would tend to depress investment. If the minimum threshold were so high that it applied in all countries, then there could be an offsetting effect in reducing the dispersion of taxes between countries, improving economic efficiency. However, at likely levels of the minimum tax threshold, our results suggest that this offsetting effect would be small, or non-existent.

[1] In the context of this analysis, the ETR is equal to an effective average tax rate (EATR).

[2] Joachim Englisch and Johannes Becker (2019) “International effective minimum taxation – the GloBE proposal”, World Tax Journal 11.4, September.

Recent relevant research from the Centre for Business Taxation:

The OECD Global Anti-Base Erosion (GloBE) Proposal, Michael P. Devereux, François Bares, Sarah Clifford, Judith Freedman, İrem Güçeri, Martin McCarthy, Martin Simmler and John Vella.