The GloBE Proposal: Revenue Consequences of a Minimum Tax on Foreign Profits of Multinationals

Last week the 137 members of the OECD’s Inclusive Framework agreed to continue work on its Global Anti-Base Erosion (GloBE) proposal (also often referred to as “Pillar 2”). The core element in the proposal is a minimum tax on foreign profits derived by multinational groups.

The key aims of the proposal are to build on the BEPS project to reduce profit shifting still further, and to limit tax competition. Subsequent blogs will address the tensions between these two aims as well as other issues. Here we ask the question of whether the inevitable costs of introducing a new system of taxation – including considerably more complexity – is likely to be worth it in terms of the additional revenue generated.

The results reported here come from a comprehensive new report published by the Centre for Business Taxation. The report estimates how additional tax revenue would be raised if GloBE were introduced on a worldwide basis, and which countries would benefit from the additional revenue. In our calculations, we assume that there would be no carve-out based on having substance in a country, and we do not allow firms or governments to change their behaviour in response to the introduction of the minimum tax. So our estimates should be seen as a benchmark against which both a substance carve-out and behavioural responses can be evaluated.

We analyse two options: a minimum level of taxation for each multinational affiliate within a country (the country-by-country approach) and a minimum level of taxation of the aggregated foreign profits of each multinational (“blended” across the multinational group). Our base case results assume that the minimum rate of tax will be set at 10%, but we also investigate the consequences of varying this. Finally, we assume that the taxing right would be allocated to the country where the group parent company is located. This seems a likely allocation of the taxing right but is only one option.

A country-by-country implementation

Our analysis combines macro and micro data. We use macro (country-wide) data on the profit and tax of affiliates of foreign multinationals located in each country. We combine this with micro data at the subsidiary level, which allows us to account for variation in in effective tax rates within a country. Using only micro data is not possible as they are not available for all affiliates of multinationals, and generally not for affiliates located in low-tax countries. Both sources of data present significant challenges, which are set out in the report, and which means that the results should be interpreted with caution.

Our central estimate is that if implemented on a country-by-country basis and with a minimum tax rate of 10%, the minimum tax proposal would raise worldwide tax revenue by about $32 billion. This amounts to around 14% of taxes currently paid by foreign affiliates of multinationals, and around 1.7% of global taxes on profit paid by the corporate sector.

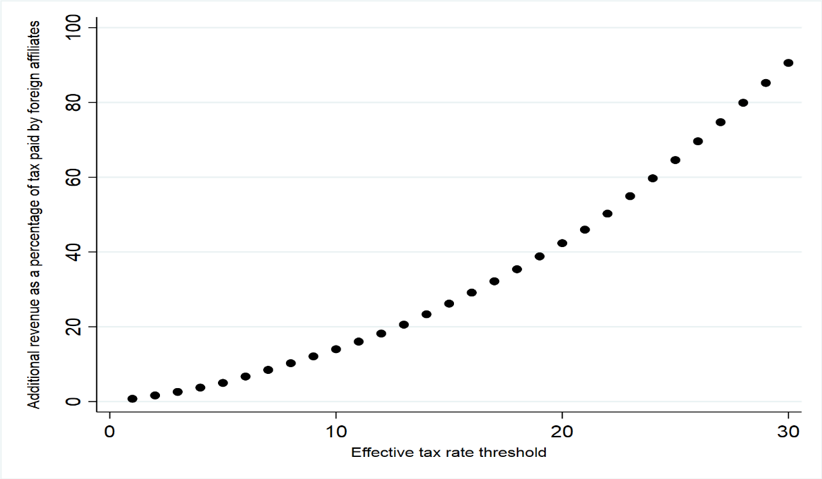

The Figure below show how revenue (expressed as a percentage of taxes paid by foreign affiliates of multinationals) for different levels of the minimum tax threshold. The relationship is non-linear; as the threshold rises, businesses pay more tax, but also additional businesses are drawn into the minimum tax net.

Revenue at different minimum tax thresholds

Unsurprisingly, a substantial part of the additional revenue would originate from foreign affiliates located in countries with relatively low statutory tax rates - such as Singapore, British Virgin Islands, Puerto Rico, Ireland and Bermuda. However, some revenue would also be collected in countries with relatively high statutory tax rates, since there is considerable variation in effective firm-specific tax rates within countries.

We use information on ownership by ultimate parent companies to estimate which countries would receive this revenue. Given the complexity of corporate ownership structures, these results should only be seen as indicative of broad patterns. In absolute terms, we find that large economies such as China and the US collect a substantial portion of the overall revenue. This finding is in line with the fact that these countries host the parent companies of more (and often larger) multinational groups. However, countries with favourable conditions for holding companies - such as Panama and Hong Kong - are also on the list of countries that collect the most in absolute terms.

Blended approach by multinational

The minimum tax could also be applied on a multinational group, rather than country-by-country, basis. This would aggregate profits and taxes paid by all foreign affiliates of a multinational group. Having an ETR in one country below the GloBE threshold would then not trigger an additional tax burden if the overall foreign ETR of the multinational was above the threshold. Since multinationals are likely to operate in high-tax as well as low-tax countries, this “blended” approach would – for a given tax threshold - raise less revenue than the country-by-country approach.

To assess how much revenue would be collected in this scenario, we use data from the consolidated financial statements of publicly listed multinationals. Given weaknesses in these data, we are only able to calculate the additional tax revenues on a reliable basis for 15 countries.

Our central finding is that, if implemented on a blended basis with a 10% threshold, the minimum tax would raise taxes paid by foreign affiliates of multinationals by 4% on average, although this hides considerable variation amongst countries. France, Italy and the UK would raise less than 1% of foreign taxes already paid. Ireland, South Africa and Norway would raise in excess of 10%. Using instead a threshold of 5% would result in additional taxes paid by foreign affiliates by 1%; a threshold of 15% would result in additional taxes of 10%.

Conclusions

Introducing a minimum tax worldwide would be complex, create new uncertainties, and inevitably involve large transition costs. To the extent that the aim of the tax is to raise additional tax revenue from profit, then it does not appear likely to deliver significant gains. On our best estimate - conditional on the caveats mentioned here and explored further in the report - the country-by-country approach with a threshold of 10% would raise the taxes paid by affiliates of foreign multinational by 14%. A similar blended approach would raise them by 4%.

These are small relative to total revenue from taxes on profit; even the country-by-country approach would raise additional revenue of less than 2%. If a substance carve-out were included as part of the package, the additional revenue would be lower. To put this in context, a one percentage point rise in corporation tax in the UK would raise tax revenue by around 5%.

The likely revenue from the minimum tax proposal therefore seems small relative to the likely costs that would be associated with it. The revenue gains from a minimum tax do not therefore seem to be a convincing rationale for introducing it. In subsequent blogs we will address both issues of implementation, and whether there may be other significant benefits.

The OECD Global Anti-Base Erosion (GloBE) proposal, Michael P. Devereux, François Bares, Sarah Clifford, Judith Freedman, İrem Güçeri, Martin McCarthy, Martin Simmler and John Vella.