Budget 2023

Corporation Tax Reform – finally, a reversal of the Lawson 1984 reforms

Today the Chancellor announced that investment in plant and machinery would be immediately expensed for tax purposes for the next three years. That is, 100% of new expenditure will be deductible immediately against taxable profit. At the same time, as previously announced, the corporation tax rate will increase from 19% to 25%.

This is a reversal of the famous reforms introduced by Nigel Lawson in 1984. Then, Lawson cut the corporation tax rates from 52% to 35%, and abolished immediate expensing in favour of a 25% allowance.

Revenue Cost

The cost of more generous allowances for investment is substantial. For example, in 2024/5, the cost is estimated to be £10.7 billion. However, this should be set against the revenue gains from the increase in the tax rate. When this was announced in 2021, the anticipated increase in revenue for 2024/5 was £16.3 billion. Putting these together, the government should raise just under £6 billion in 2024/5 from the combination of the two reforms.

Effect on the level of investment

The net effect of the current changes is to move the tax system closer to one that taxes only economic rent, or super-normal profit. The normal return on investment is now largely tax-free. The higher tax rate will therefore fall primarily on economic rent (indeed, combined with interest deductibility, the tax base will be smaller than economic rent), and will therefore have a smaller impact on the incentive to invest.

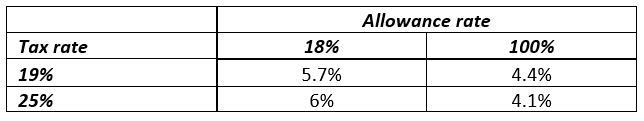

The impact on the level of investment (conditional on it being undertaken in the UK) is generally measured by the effect on the cost of capital. On a conventional measure, and assuming 30% of investment is financed by debt, the table shows the impact of the two changes separately and together: as rise in the corporation tax rate from 19% to 25%, and a rise in the allowance rate from the basic rate of 18% to 100%.

Final Cost of Capital

We assume that the financial cost of capital is 5% in the absence of tax. Immediate expensing therefore reduces the cost of capital, and effectively subsidises marginal investment.

The empirical literature suggests that the elasticity of investment with respect to the net-of- tax cost of investment as high as -6. Translating these two changes (in rate and base) on the cost of capital effects into an effect in investment, the overall changes are therefore likely to stimulate a very significant increase in investment, possibly as high as 35% in the short run, relative to the reforms not having taken place. If maintained in the longer term, the longer term effect on the level of the capital stock would be more modest, but still around a 6% increase.

Effect on the location of investment

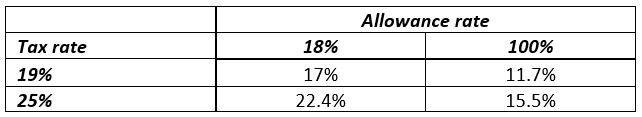

The increase in the tax rate to 25% will tend to increase the average rate of UK tax, which would make the UK less attractive to multinationals choosing a location for their investment. However, this effect is more than offset by the large increase in allowances. The next table shows the impact of the changes on the effective average tax rate.

Effective Average Tax Rate

The empirical literature suggests that the semi-elasticity of inward investment with respect to the EATR is -3.2. The overall effect of the two reforms is to reduce the EATR, and so they are likely to increase inward investment into the UK by nearly 5%.

The overall positive effects on UK investment of the corporation tax changes seem likely to be rather larger than predicted by the Office for Budget Responsibility.

This blog has been revised to correct an error in the earlier version in the discussion of the impact of the tax changes on inward investment.